Is this the part where Americans are supposed to be "shocked" by such a story?

I guess so.

Wow.

"Mr. Lereah, who says he left NAR voluntarily, says he was pressured by executives to issue optimistic forecasts -- then was left to shoulder the blame when things went sour. "I was there for seven years doing everything they wanted me to," he said, looking out his window to his tree-filled yard in this Washington suburb. Mr. Lereah now works at home, trying to rebuild his career and saddled with a sagging portfolio of real-estate investments."

Really? "Optimistic forecasts?"

Gee, whatever do you mean, David?

Realtors across the country willingly pay dues to this same association, the National Association of Realtors (NAR), which, in exchange for the cash, provides ethics training for its members (*ugh*), housing market statistics and kool-aid flavored commentary to the prospective home-buying American public, usually in the form of bullish messaging, like "Buy now!", "Rates have never been this low!", "Get in now while you still can!", and that all-time real estate agent favorite: "It's a great time to buy a home!".

And that messaging worked.

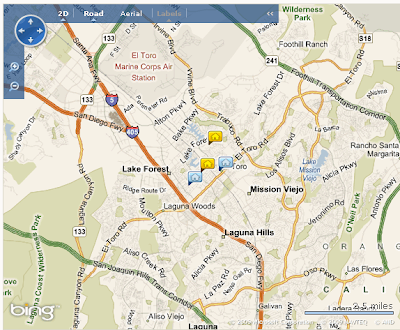

The WSJ article does not close without first appealing to our sensibilities. Afterall, Mr. Lereah has lost out as well. He's apparently lost hundreds of thousands of dollars on his own personal housing investments too. And more importantly, he may have lost credibility as an renowned economist.

Intentionally painting a rosy picture of a unsustainable housing market situation is not what housing economists are normally paid to do. They're usually paid to be objective, factual and to interpret the incoming data with great care, because Americans consumers often make financial decisions based upon those interpretations and trends. Mr. Lereah had an important responsiblity.

So it must be a steep challenge indeed for one to re-establish credibility in the shadow of intentionally misrepresenting data all in the name of satisfying an employer's crooked business objectives, or for that juicy six figure paycheck.

This is all such a huge joke.

As long as we have Realtor sales commissions directly tied to the value of home sales prices, American consumers will face a conflict of interest. The business relationship is sort of damned from the start.

Even if we choose to assume that Realtors provide a valuable service, and that this service should be paid for by consumers (for all the marketing materials, providing professional consultancy on local real estate conditions, negotiating pricing and terms on behalf of the buyer, etc.), there is no way such Realtor services should be a a function of the home sale price.

This would all go away if Realtor sales commissions were instead tied to a fixed fee not at all linked to the sales price of the house and more a function of the value of the consultancy provided (i.e. a measure of the consumer's risk in choosing the wrong home, or paying the wrong price, among other variables).

Change is needed, because otherwise we will continue to see Realtor-funded organizations like the NAR, and state-based versions thereof, do everything they can to preserve high home prices, preserve low interest rates, etc., and for what?

For their own personal gain.

Consider that right now that the best thing for our anemic American economy (and for a speedier recovery from the housing downturn) might just be the opposite of what American Realtors want:

- stronger enforcement of fundamental mortgage lending standards (documented lending processes) and borrower qualifications.

- strict adherence to realtor code of conduct

- higher bank and mortgage interest rates, increased motives to save money and a strong US dollar currency.

- lower (and more affordable) single family home prices that reflect market fundamentals like real take home earnings of prospective buyers

- 25-30% downpayment requirements

- open access for consumers (prospective home buyers) to all home listings

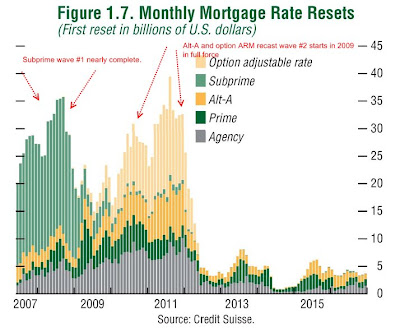

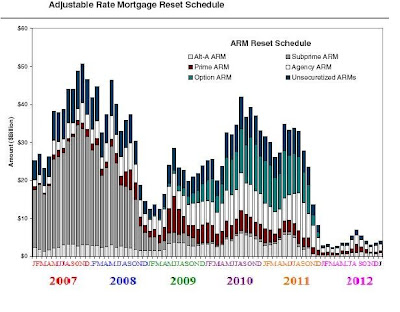

If Americans wish to know how we got into this financial mess, they may not need look further then their local real estate agents who cheerleaded hundreds of people to buy homes that they could otherwise never really afford, homes that "never go down in value", who tapped the shoulders of local mortgage buddies around the corner who suggestively sold poor quality, adjustable rate mortgage instruments, that the consumer could (in theory) "always refinance".

If college textbooks ever get around to printing a few case studies on the Great Housing Crash of 2006, they might mention that there was an even greater problem than David Lereah, the NAR, the Fed, the SEC, and Realtors themselves. It was the laziness of the American media and complete lack of investigative journalism.

From CBS's "60 Minutes" to CNN to Fox to even the LA Times. Media outlets continue (even today) to turn to discredited NAR and CAR representatives for interpretations of the housing market data, as if they are "trusted advisors" for the real estate industry, when that claim must instead be officially surrendered for all time or until the real estate industry reforms for the better.

In the meantime, fixed rates for realtor services, full and free access to market information for consumers, and then let us allow the market shake itself out. It always does.

And as for Mr. Lereah, if that consultancy gig doesn't work out, I suppose he can always become a Realtor.