Wednesday, May 18, 2011

Lake Forest: In God We Trust. But which God? And why?

I think this motto was a dumb choice because:

a. it's unoriginal as hell. That motto is on our currency already for the love of Venus, and

b. it makes no sense.

In God We Trust

In what God, precisely, are we supposedly placing our trust?

Yahweh?

Allah?

Vishnu?

Zeus?

Zoroaster?

Apollo?

Venus?

Wotan?

Thor?

Jesus Christ?

Ra?

Jengu?

And what does such trust in one or numerous dead deities have to do with our community?

I would have preferred "In reason and common sense we trust". At least then everyone on the planet, let alone the local community, would know what the hell the city government of Lake Forest is taking about.

The United States of a America is a federal constitutional republic. It was not founded on Christian principles or by the words of the Bible (the inerrant word and inspiration of the Abrahamic god Yahweh). I'm sure that's the deity this young Eagle Scout, his mentors and our mayor-without-a- backbone are referring to. And they were presumably all born in the United States and brought up to believe in Jesus Christ and the Holy Trinity (Father, Son, Holy Spirit), yadda, yadda, yadda.

But had they been born in Iran during the time of the Persians they would have believed in Zoroaster. If they would have been born in the time of the Vikings they would have believec in Loki, Wotan and Thor.

Personally I'm an atheist. I used to be a Christian. A Lutheran to be exact. But I'm not anymore. I don't believe there is sufficient evidence for the Christian God. And even if there were sufficient evidence, the instructions written in the Bible around which we are asked to organize our lives does not lead me or any reasonable person to believe that Yahweh and Jesus Christ are worthy of worship. No. Too much blood, slavery, war, ignorance and bronze age megalomaniacal thinking for my taste. Before you as a reader get pissed off at my opinion here, I'm open to being convinced. Most Christians know exactly what it's like to be an atheist though, because I bet that none of them lose one second of sleep over the fact that millions of contemporary Muslims today believe Christians and heathens like me to be in the express lane to everlasting damnation.

All I'm saying is that not everyone who lives in Lake Forest organizes their life around some celestial CCTV camera in the sky. It seems to me that a better, more original and more inclusive motto than "In God We Trust" could have been chosen that wouldn't trample on the beliefs or lack of beliefs of local members and taxpayers of this beautiful community.

Misdirected Resentment? The John and Ken Nation and Russian Economy Class Passengers

I met this business man who started selling American electronics and software into Russia at the earliest stages of their new market economy, around 1993-1994 timeframe. This was around the time that Boris Yeltsin was the President and Russians were already well on the transition path away from Soviet rule and into a more oligarchic power structure.

We were on a plane together heading to Moscow for a trade show and he shared with me several stories about the importance of understanding the "Russian mentality" and their jaded views regarding social and economic class. We were sitting in economy class together when he leaned over to share what he considered a special nugget of wisdom:

"You have to understand that Russians are not like Americans”, he said.

“Not at all. These Russians sitting back here with us in economy class.... they're not looking up at the first and business class passengers and thinking to themselves, Man, what do I have to do, how do I apply myself, what knowledge, work and effort do I have to put forth to get to sit up there in First Class too? No. You want to know what they're really thinking? They're thinking, "What do I have to do to make sure those f***ing assholes sitting up there in First Class are brought back to sit right next to me here in cattle class?"

I don't relay this story to disrespect Russians in any way whatsoever. I have Russian friends who have laughed at this story too. The truth is we Americans are very much like those Russian passengers in economy class back in 1993. The widening gap between the have’s and have not's in the United States of America is unsustainable and sadly it’s only getting worse. Besides, no one likes to see state and government employees living high on the hog while others are jobless for months, getting foreclosed on, taxed and fee'd into oblivion by the very governments charged to serve them. Oh, and let’s not forget the national and global embarrassment that is California’s K-12 academic performance.

As pissed off as I may personally be about the overvaluation of the California housing market and the slow crash and burn of housing prices right here in Orange County, and about the massive California state budget crisis, ridiculous state employee salaries, pension programs, and the incorrigible practice of "double-dipping", I can't help but think that we're missing something here.

Whenever people get so pissed off about what they believe others have, or have done, or got away with, particularly in government employment and government-related institutions, I start to wonder whether that collective outrage isn't being misdirected somewhat.

In the case of California, I think it is misdirected. This article by Saree Makdisi of the Sacramento Bee reminds me not pile all of my fury on the irresponsible leaders in Sacramento, the CTA and NOCUT. Oh, they deserve it. But there are asswipes on Wall Street and in Washington well deserving of our contempt also.

I live in California. I don't want to be taxed any more than I already am today. At the same time I would say that I’m ok with paying taxes, as long as the services being provided to me are satisfactory or good. With respect to education, I personally want California teachers to make as much money as possible in their profession. That's right. The sky should be the limit on California teacher compensation as far as I'm concerned. No caps whatsoever. Attractive pensions too? Sure, within reason, yeah, why the hell not? But in exchange for such a policy to attract the very best with appealing compensation packages, funded by community employment and income tax dollars, California should be allowed to fire the asses of poor performing teachers without any cushy severance packages.

I'm not interested in their BAs or MBAs. So what! Nobody cares about that. I care about the numbers: science and math test scores, API results, graduation rates, college admission rates, and overall academic achievement in all phases. The notion that teachers cannot be fairly assessed is unfounded. It's not fair to taxpayers, nor is it fair to those teachers who are royally kicking ass out there in K-12 education and especially special education.

Anyway, when I tune into the radio program of John and Ken on KFI 640 AM here in Southern California (Orange County) and listen to their ridicule of the California teachers unions and other state employee unions, I totally get it. I understand and identify with this anger. I think their investigation and commentary are coming a little too late to help anybody (where the fuck is America's investigative journalism anyway?) and they’ve tried to over simply a very complex situation which can be simply explained by greed and lack of oversight. Regardless, all of this puffed up objection and indignation would have serviced listeners better BEFORE such sweetheart salary and pension deals were even put to paper, let alone signed.

"Can California tax payers stop we being so damn stupid?" The answer is probably not.

It’s difficult to imagine the levels of incompetence required to screw things up this badly. California is the highest taxed and fee'd state in the union and the worst state imaginable to open up a new business. And the state appears to be one of the only places on the planet where government financial scandals the magnitude of the Bell Community can take place. Nobody is paying any attention to what state and municipal lawmakers, school boards, and county and state union PACs have been up to. This is how your K-12 education system arrives in the toilet, ranked 48th in the land right ahead of Louisiana, Alabama and Mississippi. Yet, despite that kind of substandard performance – one that would normally result in immediate and mass firings for replacements in the private sector - California teachers actually have the balls to request the extension of tax increases so that they don't lose their jobs and that their class sizes don't balloon up any further. Make no mistake about it, teachers in southern California, and in Saddleback School District as one example, are extremely well paid already. The numbers suggest that a tiny little bit austerity for teachers and school administrators is now in order. And it isn't going to hurt or destroy California children either. Sure, California K-12 students might be getting the same or worse deal as their counterparts in Louisiana as a result of these budget cuts, but that’s no reason to waste more taxpayer dollars with demonstrations and complaints. In the private sector, if you fail to perform, you hit the bricks. Start performing first.

While the disgust is washing over us every day about these budget developments, for some reason we’ve decided to turn a blind eye to the real cause of this disaster. The truth is that over the last 24 to 30 months Americans have already forgotten what happened in the financial sector and the policies and decisions that fleeced all of our wallets for $13 trillion dollars, or $42,000 per man, woman and child in the country. No questions were asked. No referendum vote. No nothing.

Where’s the national outrage for what occurred then?

If only John and Ken at KFI and investigative journalists of America would expend as much effort to put the Federal Reserve leadership (past and present), State Congressman and the President's "head on a stick" about that 2008-2009 fleecing of the American taxpayer.

Tuesday, March 1, 2011

Vendaval Denial

The irony of Vendaval:

(′ven·də′väl):

(meteorology) A stormy southwest wind on the southern Mediterranean coast of Spain and in the Straits of Gibraltar; it occurs with a low advancing from the west in late autumn, winter, or early spring, and is often accompanied by thunderstorms and violent squalls.

Is it too much to ask for the storm to stop and some normalcy to return?

Perhaps it is. Even in 2011.

For now the denial and incessant waiting continues.

24761 Vendaval

24761 VendavalLake Forest, CA 92630

Beds: 4

Bath: 2.75

Sq Ft: 3,249

Lot: 6,000

This beautiful home located in a lovely and rather secluded community with nice green belts and parks in Lake Forest, California was purchased for just shy of one million dollars ($910,000) back on October 24, 2006. It was then bought by an investor at foreclosure auction for $618,500 cash on May 28, 2010.

Following listing in late September 2010, 155 days on the market later this home remains priced at $729,000, which in case the seller forgot is only slightly less the 10 TIMES the median income for this small city. Only the investor knows how much was poured in to this adobe between May and September to make it move-in ready. Laminate wood flooring is nice, but not very expensive. The $110,500 proft being targeted provides us only an inkling.

A local comparable sale on December 3, 2010 went for $730,000 - same style and sized home, similar location - a signal to the seller that $729,000 is a perfectly reasonable asking price too. Will the angry real estate gods of Orange County to shine down with favor once more upon a turbulent sea of Lake Forest home sales signed at prices well below $650,000?

The neighborhood is nice and ideal for a family to live. The schools in the area are quite good. You can check out the schools' API scores here (type in the school name).

Saturday, July 3, 2010

Swan Drive or Swan Dive?

There are plenty of people out there in Lake Forest, California who believe housing values will come roaring back to 2005 levels any second now.

Here's another textbook example of devastating value loss in the community suffered mainly due to a complete inability to accept reality:

23952 Swan Drive, Lake Forest, CA

23952 Swan Drive, Lake Forest, CASingle family

4 bedroom

2 bath

1,471 sq feet

5,035 sq foot lot

Previous Sale 9/13/2005: $659,000

LISTING PRICE: $389,999

It boggles the mind to consider that only 5 years ago in 2005 some nitwit agreed to pay $659,000 (over 10 times the median income in the county) using what looks to be close to 100% financing - all not just for the pleasure of listening, but of facing 12 lanes of roaring traffic generously provided free of charge by the State of California and the 5 San Diego Freeway.

So what you're saying is I get the fortune of living right next to one of the busiest, smog-choked highways in the nation?

So what you're saying is I get the fortune of living right next to one of the busiest, smog-choked highways in the nation?As if that were not enough comedy for you to consider, the home was listed for sale just two years later in October 2007. The proprietor has been chasing down the market ever since. The property is now in foreclosure and facing auction later this month at an estimated market value of $342,000 (Realtytrac). And the home is still up for sale (207 days?) listed at $389,999.

So what lending institution did their homework and looked at the appraisal data on this property? Express Capital Lending. Nice.

Just to add more insult to injury, the previous owner purchased this healthy lifestyle winner back in October 2001 for $198,500. Now think about this for a moment. The previous owner managed to successfully sell this carbon monoxide ranch only 4 years later for almost half a million more? With a $659,000 listing price today, one would believe the owner to be chronically high on highway 5 fumes!

It'll be interesting to see how this home fares at auction. $389,000 seems delusional to me. Now I know that "beggars can't be choosers" when it comes to buying homes and I like getting high as much as the next person, but I'd rather be a beggar than give myself and my kids emphysema living right next door to the damn freeway.

Sunday, June 13, 2010

Greenacres: The Place to Be?

In 2005 life was obviously very good in Orange County, California. There were so many things you could see, do and achieve. It never really mattered how much money you actually earned from your employment or what you're disposable income looked like after all expenses and debt payments. All that mattered during this glorious slice of time was how much you could borrow. Banks throughout the land enabled all Americans - both rich and not so rich - to borrow heaps and heaps of dough.

In 2005 life was obviously very good in Orange County, California. There were so many things you could see, do and achieve. It never really mattered how much money you actually earned from your employment or what you're disposable income looked like after all expenses and debt payments. All that mattered during this glorious slice of time was how much you could borrow. Banks throughout the land enabled all Americans - both rich and not so rich - to borrow heaps and heaps of dough.It is shocking to consider the shear amount of money that Californians not only borrowed to buy their primary residence or investment property, which was sometimes $500,000 or even more, but also how much they borrowed on top of all of that in the form of HELOCs (home equity lines of credit) loans, which the consumer could use...well, for almost anything from a set of new kitchen counter tops, to a new Harley-Davidson motorcycle, to a vacation for two in the Azores. It didn't matter what you're net paycheck looked like, or your next paycheck for that matter.

The banks who gave lent the money did not care. So why should anyone have cared?

Here's a single family house in Mission Viejo that was first listed for sale June 20, 2005, a full three months after it was purchased in March 2005 for a whopping $930,000.

Here's a single family house in Mission Viejo that was first listed for sale June 20, 2005, a full three months after it was purchased in March 2005 for a whopping $930,000.What's interesting is how this house was listed and then delisted over and over again in utter futility over a period of 4 years. Why?

Today (June 2010) it is listed once again for sale at $715,000. With a 20% down payment of $143,000, the income requirement to purchase this bad boy is $141,500 assuming 5% mortgage and zero other monthly debt liabilities (I've always been interested to know just how many people in Mission Viejo bought their cars for cash, i.e. have no auto loan(s)) This home is located in the Capistrano Unified School District, which is on it's 7th superintendent in just 4 years. Given the recent district turmoil from questionable past leadership and the impact of the California budget crisis might be something for prospective buyers with families to think long and hard about.

28861 Greenacres, Mission Viejo, CA 92692

4 bed

2.5 bath

2,800 sq. feet

6,000 sq. foot lot

457 days on market (technically speaking yes, but based on original list date)

Asking: $715,000 (Correction - MOVED UP TO $745,000 on day of post!)

Last Purchase: March 2005, $930,000

HEYYYY! Great to see you again! Where have you been!?

This is a beautiful house. The owners took good care of it. But given recent comparable sales (comps) of like size and features that have sold in the $650K range, Greenacres comes back to us somewhat (update: way) overpriced. This is common to see everywhere in Orange County, I believe, whenever sellers and banks try to place a tourniquet on monumental financial mistakes of the past.

The thing is, it's been 4 freaking years since the original purchase. I mean, I don't know what it was listed for in 2006, 2007, 2008 and 2009 (I wish Redfin kept a history of this), but hasn't the train sort of left the station already on $745,000?

We'll soon see.

Sunday, June 6, 2010

A Few Tools for Prospective Orange County Homebuyers: School Locators and Performance Rankings

As if the uncertainty associated with the Orange County residential housing market weren't worrying enough on it's own with all of it's cookie-cutter home designs, HOA fees, high home prices, ridiculous FHA financing exceptions, as well as a tidal wave of shadow inventory and foreclosures ready to drench the streets, any prospective home buyers here that already have children or are planning to have children had better take time to consider the important question of schools.

When shopping for a home in OC, so much energy and stress is wrapped around the size of home and the ridiculously high prices one encounters here. This is natural because unlike the glory days of Orange County's Christmas past, today you sort of like have to be able to...wait for it....really afford the house you're going to live in.

During the home procurement process, school districts and school performance may end up being an oversight for some. But since buying a home is the single largest financial outlay of anyone's life, failing to consider schools could be a costly mistake not just for buying today, but also when trying to sell the same home later on.

Besides everyone by now should know that the California budget crisis is a very, very serious problem. The lack of past spending and budget accountability controls in Sacremento and throughout the state will not be resolved promptly nor thoroughly. Incredibly extend and pretend politics have this crisis already dragging on longer than necessary. The budget crisis is having devastating consequences for local schools and communities in Orange County school districts, such as Capistrano Unified, including Saddleback Valley Unified School District. Even after past school closings, program cuts, elimination of transportation, teacher layoffs, larger class sizes and new pay cuts, risks remain high that Orange County will see more of the same in coming months and years, including future school closings, redrafting school district boundaries, changing student transfer rules and more teacher layoffs.

Still, it is important to bear in mind those things outside of one's control and focus on those items that lie within one's control.

If we buy that house, which school(s) will our children attend?

How good is that school?

It's impossible to predict how this massive clusterfuck of a state budget will end up, for the Saddleback Valley Unified School District (as well as others in Orange county) there are some nice website tools already available that prospective home buyers can use to help them make a slightly more informed decision.

Tool #1 Saddleback Valley Unified School Locator

This tool allows you to simply type in the street name of the home you are interested in buying. The website then outputs the three main schools that are "resident schools" that your children would likely attend for elementary, intermediate (middle) and high schools. You can then look up the API ratings and Great School ratings for these schools.

Tool #2 California Public School Ratings

This website shows the API or Academic Performance Index for each elementary, middle and high school in the state. The API index is a scale from 200 to 1000, which 1000 being the best.

Good elementary, middle and high schools usually reside in the 800+ category

Tool #3 Great Schools California

This is more a subjective school rating site where parents and students can contribute their reviews and ratings of every school in the state. The site still shows scores for schools in Orange County that have closed, such as O'Neill in Saddleback Valley Unified (Lake Forest).

Unfortunately, specific, sorted information regarding the performance and/or ratings of special education programs (SDC) for children at Orange County schools is not unavailable today. For answers to such questions one must turn to the specific special education director and program specialists for the school district.

Monday, April 19, 2010

Seller at Open House Was Actually A Realtor

I went to an open house two weekends ago in Mission Viejo, California. It was a really nice house not on my original list of must-see interesting properties. It was one I just noticed while driving around. The yard sign said "Open House", so I decided to pull over and take a quick look. No realtor was present to greet me. Instead, the proud owner showed me the home throughout and did a pretty good selling job too. Then I glanced at the crisp, glossy brochure. This home was priced over $890,000, so I was already thinking to myself "no fucking way". I mean, some of the homes in that same area had been price much, much cheaper, but this was a really nice home. A lot of nice extras added in. It was the kind of place that just screamed "HELOC!" at you.

I went to an open house two weekends ago in Mission Viejo, California. It was a really nice house not on my original list of must-see interesting properties. It was one I just noticed while driving around. The yard sign said "Open House", so I decided to pull over and take a quick look. No realtor was present to greet me. Instead, the proud owner showed me the home throughout and did a pretty good selling job too. Then I glanced at the crisp, glossy brochure. This home was priced over $890,000, so I was already thinking to myself "no fucking way". I mean, some of the homes in that same area had been price much, much cheaper, but this was a really nice home. A lot of nice extras added in. It was the kind of place that just screamed "HELOC!" at you.The owner knew it was out of my range. Don't ask me how, but it was cool.

I said thanks and was making my way to the door to leave when the owner started to ask me a series of questions, like whether I was working with a Realtor already. When I answered "yes", the owner didn't say "I'm a realtor too", but then proceeded to ask me a lot of questions about what I was looking for in a home and when I intended to buy, and then whether he could start to send me listings.

I'm like, WTF, I just told you I'm "working with a Realtor". I thought that was universal code for Realtors meaning: "Does not compute. No commission opportunity. Say Goodbye and Thank you. Seek New Target to Destroy."

But no.

This is not the first time this has happened to me either. I'm sort of new to home shopping in Orange County California, but maybe it shouldn't surprise me to see the amount of client poaching going on out there these days. It doesn't matter how forthright you are, or whether you state clearly "Yes, I'm already working with a Realtor!". I've noticed that many Realtors - and I'd say 1 out of every 2, will still try to sell you their agency over others.

This is probably fine as an attempt to get more business. I understand that completely. But if you're a Realtor, I can't imagine this approach working very well. And for me, you better damn well come prepared with some pretty impressive references. For example. I want to see references from your last 7 to 10 clients (homebuyers), because I'm going to call on them and ask them about your services and performance. I'm also going to ask them about your bedside manner and what sales tactics you employed. Did you pressure them into buying more house than they could afford? Did you tell them the truth about the value of the home they were buying despite what the liar loan "comps" were at the time? Did you recommend the buyer to a favorite, skid-greasing lender of yours, and if so, were they happy with the mortgage product they wound up with?

I think these are fair questions to ask. And no, I'm not expecting many Realtors to cooperate with such requests and voluntarily open closets to me like this. Too many bones might come flying out.

But sales is all about building customer relationships. It's also about building trust.

Why Don't Renters Receive A Tax Deduction In Kind?

Following the wildly successfully Open House Weekend in Southern California and Orange County, I was taking inventory of all the cash being thrown around by our federal government ($8000 federal tax credit) and the now de facto bankrupt state of California ($10,000 tax credit over 3 years) and I asked myself a silly question:

Why are any American taxpayers supporting or subsidizing this approach?

I think the answer is that as human beings, beliefs inform our actions. If you believe that the national and/or state economy will only turnaround by re-invigorating and re-inflating a collapsed asset bubble like real estate instead of subsidizing local jobs and new industries, then you will no doubt support such real estate tax subsidies. If you only get paid when a home is sold (due to the lure of such tax subsidies), then you'll also no doubt lobby support for such subsidies to continue.

My question is why can't renters receive similar tax benefits and subsidies?

Is it because Realtors don't get paid a commission when a renter extends his lease contract?

I can't think of any reasons why renters should receive fewer benefits on the national and state tax front. Or conversely, I can't think of why renters should suffer more under the current federal and California state tax codes.

Renters also have tight household budgets. They have work obligations. They pay federal and state incomes taxes. Many also have families, as well as short- and long-term financial goals that they strive to meet. Renters also volunteer and serve local communities. It might also surprise people to know that renters also happen to vote. The President of the United States, members of the US Congress, the Governor of California and the entire state legislature in Sacramento would be wise to remember this last point.

The suggestion I keep hearing is that renters don't pay property taxes, and therefore are equivalent in some way to a second-class citizen on par with extortionists and tax evaders. It is argued that renters sidestep responsibilities to the greater good and the community at large. By not paying property taxes directly, renters don't help to fund local schools and keep cities and towns "nice" and "safe". Because they do pay property taxes directly, homeowners (most of them actually homedebtors) meanwhile are to be commended and rewarded by both state and federal government (and thus by taxpayers everywhere) in the form of tax breaks and loopholes.

Is this fair taxation?

I consider it unfair and I would continue to believe so even as a homeowner (homedebtor) myself someday.

Maybe I'm old-fashioned, but I prefer to pay my own way. I don't like freeloaders. And I dislike the idea of anyone portraying me as such just because I didn't buy a $700K single family home when I first moved here five years ago.

The property tax argument is also ridiculous. Any landlord who is a landowner (or landdebtor) who pays property taxes himself, but fails to apply or distribute such costs to his tenants via the monthly rent charge might be a nice person, but he'd also be considered a financial imbecile, or both. Renters do pay property taxes. It's embedded in the rent they pay.

So I just don't get it. As a renter, I'm already accustomed to paying my fair share of income taxes both state and federal. But why are home debtors afforded greater protections under the United States federal and state tax codes?

Can someone explain to me why this is? How is this arrangement fair and equitable, and more importantly, what convinces people that these $8000 and $10,000 tax break arrangements are money well spent, benefiting the greater good to such an extent that no other options or subsidies be considered?

Seriously, I'd really like to know an answer or two.

Friday, April 2, 2010

A Challenge to America's Realtors

I would like to issue the following challenge to every single active Realtor(R) in the United States of America to make a series of phone calls this coming week to your top five (5) home sales clients (home buyers) in terms of highest sales transaction value for each of the following three years: 2005, 2006 and 2007.

1. Ask them how they are doing? Job? Family? Finances?

2. Are they still happy with their new home?

3. Are they happy that they bought the home when they did?

4. Is there anything they would have done differently?

5. How has the financial meltdown and housing crash affected their lives?

6. Would they accept your Realtor services in the future?

Good luck.

Please add responses in the comments section.

Thank you.

Markus Arelius

Monday, March 29, 2010

Principal Reduction Plans: Obama's "Screw You!" To Responsible Taxpayers and Savers

You were wrong.

You were wrong not to leverage yourself into oblivion along with everyone else between 2003 and 2008.

You were wrong to try and save money for your retirement, your children's education, and that not too distant "rainy day" your parents told you about as a kid.

You were wrong to wait for rental parity.

You were wrong to keep scraping just enough money together month after month in order to stay current on your upside down mortgage.

You were wrong to rent, and no, you'll receive no taxpayer-funded financial relocation incentive. That privilege is reserved for financially inept home debtors only, not smart, hard working savers.

You were right to game the mortgage lending system and lie about your income.

You were right to throw caution to the wind because real estate never goes down in value and even when it does, there's a safety net bought and paid for by your stupid tax-paying neighbors to catch your dumb ass when you come careening downward.

You were right to siphon the hundreds of thousands of dollars out of your home with home equity lines of credit (HELOCs) so you could buy those granite countertops, trips to Hawaii and that pathetically stupid looking white Lexus SUV for your wife.

You were right to follow the advice of corrupt real estate sales people and all of their army of duplicitous, REIC-bribed economists, because the effort and value associated with marketing a $500,000 house versus a $700,000 really is really worth the extra $6,000 you paid them in transaction commissions.

You were stupid to believe anyone in government, least of all a Harvard Law Review student come President, would defend U.S. contractual law or defend against moral hazard.

You were dumb to believe Barrack Obama would utilize common sense, prudence and a sense of fairness to govern

The United States of America is already headed for strategic default at 200 miles per hour. Obama's principal reduction plan just slammed the heel on the accelerator.

This really is change you can beLIEve in.

Sunday, March 28, 2010

California Homedebtors Punished for Their Arrogance and Financial Ineptitude

Look, it's not a state or federal crime to be incredibly arrogant and financially inept, but you've got to admit it sure can cost a pretty penny.

How can so many people be up to their eyeballs in financial distress?

One would have to hit the rewind button back to 2004 and 2005 with our favorite Realtor sales schtick:

1. "15% (appreciation) is in the bag!"

2. "Get in now while you still can!"

3. "They aren't making any more land!"

4. "Buy now or be priced out forever!"

5. "It's a great time to buy a home!"

6. "Interest rates have never been this low!"

Oh man. I get all woozy when I think about these jewels of Realtor wisdom.

I really wish somebody would force every single Realtor in Orange County to send out a 360 degree survey to their past clients between 2005 and 2008. I think that would make very, very interesting reading. Alas, I cannot do this, as I'm not a Realtor.

And Realtors don't have the guts nor the integrity to do this. Oh, the rage that would pour off those survey pages!

I don't blame them. It would be too disheartening to realize just how many lives can be derailed financially as a result of one's own greed - that drive to see the transaction exchange take place, regardless of the foreboding consequences.

Many of the individuals who fell for lines 1 through 6 above have or soon will foreclosure on their expensive southern California properties. They will have to pay income taxes on the amount of debt forgiven by the financial institution or bank.

Lost home. Lost credit score. Massive income tax liability.

There are those who believe these individuals deserve financial aid from state and federal government. I cannot count myself among them. You signed the dotted line. You made your bed. Many of these people scoffed at renters and savers, and those who chose not to leverage themselves into oblivion. I can only salute them for their arrogance and naivete.

The Jeronimo Zone in Lake Forest

So what's the deal with the "Jeronimo Zone" in Lake Forest, California these days?

This seems to be the only freaking area in the entire community where single family homes are up for sale at a reasonable price.

Oh, wait a minute. It must be that Amtrak line. Yeah, that's it! Dammit if young families with children settling down in Orange county don't just love to live within busted earshot of a howling locomotive.

And what about my wildfires?? I distinctly remember requesting a single family home located as precariously close as possible to one of the more hot, windy and dry areas where wildfires most easily commence in Lake Forest!

Realtors and foreclosing debt freaks, please don't disappointment me now! What do I see here but a few SF homes available in Foothill Ranch!!!!! Sweet!

Hmm, raging wildfires or eardrum bursting train horns? Eardrum bursting train horns or raging wildfires?

Aww Gee, it's so difficult to choose!

Well, according to Redfin.com, there are a whopping 16 single family homes for sales in Lake Forest between the prices of $350,000 and $600,000 (4 bed, 2 bath).

But let's just see what Realtor.com has to say:

Realtors(R) of the NAR hate Redfin.com because Redfin capriciously states the previous sales history data of listings on their site. Realtors have the MLS, and apparently much more additional information and wisdowm that Redfin could ever dream of having. This is the only conclusion I can come to because Realtor.com indicates that there are not 15, but 55 freaking single family homes priced between $350,000 and $600,000 (4 bed, 2 bath) in Lake Forest today.

Meanwhile Zillow.com thinks Redfin and Realtor.com are both full of shit, because there are not 15, and not 55, but 57 single family homes available for sale between the prices of $350,000 and $600,000 (4 bed, 2 bath).

Jesus! Get it right, Realtor.com!

All I can say today is thank goodness for two things:

1.) For Jeronimo (or Geronimo) that merciless Apache medicine man, and

2.) The high level of data accuracy and integrity that is simply flooding the real estate numbers in south OC these days.

Monday, January 4, 2010

Doctor, I have a bad case of Schadenfreude

I re-read this article today from Dr. Housing Bubble again. If you're considering buying a home in Orange County California, I highly recommend it to you.

I think it's interesting to consider such an article when laid next to the very recent views (January 2010) of realtors like this one, who has stated he believes that home prices will increase 7.5% in Orange County in 2010.

I'm not saying prices won't increase by 7.5% in Orange County. However, given the long laundry list of suspiciously errant opinions on the direction of the housing market in California over recent months, I think the Orange County register needs to demand evidence and facts, not just subjective stated opinions of realtors. I don't care if a realtor has been in his/her profession for 17, 20 or even 2 years. Answering the "what" question is not good enough. Let's start demanding that the "why" questions be answered as well.

What evidence suggests to us that the Orange County residential housing market will increase by 7.5% in 2010? I just don't see it.

Zombie Banks!

Have you checked recently whether or not the institution you bank your funds today might in fact be a walking, undead, taxpayer brain-eating abomination? I did. I bank at a credit union and it's surprisingly doing alright, financially stable. Definitely not a zombie.

Without the taxpayers whom they've royally screwed, many of the banks in America that we see today would have otherwise failed and been no more. But thanks to top tier bribery of our elected officials in Washington under the auspices of the 1st Amendment, we get....ZOMBIE BANKS!

They should be gone. New market entrants with better management, better and more competitive services and higher financially stability should have taken their place to serve the market. But no. We can't have that.

We taxpayers are the eternal host of the party to zombie banks!

Even after Lord of the Rings, I couldn't fully understand and appreciate Peter Jackson. Only after watching Braindead can one witness his true genius and apply it to our daily life. Zombies sure are scary.

CAR: A Positive Impact to the Market in Coming Months

California home sales increased 4.7% in November 2009 vs. 2008, and median home prices increased 5.8% in November as well.

This sounds fantastic. The residential housing market in California is getting revved up for a jaw-dropping recovery.

Right?

C.A.R. President Steve Goddard:

“Efforts by lenders and the government to assist homeowners at risk of foreclosure have led to fewer homes available for sale, and an increase in the state’s median home price. California’s median home price increased year over year in November for the first time since August 2007."So government and lender actions have restricted market supply ("homes available for sale") in California resulting in "an increase in the state's median home price". So the market has actually not truly corrected itself yet. Without foreclosure moratoriums and government and lender finger fumbling, we might see a different set of circumstances. Higher volume supply of homes for sale and higher pressure to lower prices perhaps?

Mr. Goddard again:

“The extension and expansion of the tax credit until April 30, 2010, along with low interest rates, should continue to positively impact the market in coming months."Is it just me or does it seems like Mr. Goddard and the California realtors he represents generally view a "positive impact" on the housing market in California to include following:

- low interest rates

- low market supply of homes for sale

- high sales prices

- federal tax incentives to encourage people to buy a home now

So I ask you:

Are low interest rates really a good thing?

For the short term home affordability? Maybe. But what happens, my realtor friends, when rates increase and the people who have been encouraged to buy now at $500K and $600K with these low rates decide to or must sell their homes in 2, 3 or 5 years and rates are significantly higher? I don't think they'll share your present views on this subject. The time to buy a home is not when rates are at their lowest, but when rates are at appropriate or even high levels. When rates go up, sale prices (and asking prices) typically must and do decline. When rates are low, sale prices are normally quite high (as they remain to be in Orange County California, for example). If I buy a $550K SF home today at 4.75%, in 5 years when rates are 8% or 9%, if I have to sell, I'm going to be f%$#ed.

Is a low market supply of homes for sale a good thing?

If you like to see high sales prices per home, then of course. This is great news for home sellers. As for potential buyers, well, this is the part where you're told to get in and pay now, miss the train, or piss off.

Are high home sales prices a good thing?

For sellers, definitely. Who doesn't want to sell a $230K piece of shit single family home in Lake Forest, California for $550K or $600K? Most homedebtors who live here already have this expectation. You'd have to be out of your mind not to love such a scenario. But why in the world would realtors be in favor of high home sales prices?

Gee, I wonder.

Are federal tax incentives to encourage people to buy now a good thing?

Government intervention certainly has it's place in both micro- and macroeconomic market scenarios. It can be a highly effective catalyst for stabilization and regulation, leading to economic recovery of either ailing and devasted (past tense) markets. The residential housing market has almost been reduced to ash in California. In some parts of the state (you know, since Real Estate is LOCAL!!), there is more incineration in store (in places such as Orange County once the tens of thousands of Alt-A and Option ARM mortgages come tap, tap, tapping at our tax-paying, chamber doors). Realtors want the government to provide the market these incentives to keep the market on life support, because if the government doesn't to this, then realtors either get lower sales commissions (from lower market sale prices per unit sold) or won't get paid at all (from far fewer home sales and transactions). I not only think this is a morally wrong position for realtors to take (as government incentives cost everyone a lot of tax dollars). It's economically unsupportable as well.

The housing market in California has been made sick by a combination of irrational exhuberance, irresponsible lending, irresponsible sales tactics, and irresponsible borrowing. What the residential real estate market in California really needs to do is take a freaking bath. First in its own blood, then in lye.

Government incentives should be withdrawn completely. $8,000 is a ridiculously small amount of money for California anyway. No more moratoriums and price baiting would spur a different market response. The supply of homes in the market would likely increase, the sales prices would decline for a time, but you would have higher affordability, good competitive bidding and more stable single family home prices over a longer term. Plus, the market would correct itself a lot faster. This would be a good thing for sellers, buyers and realtors alike - but over the longer term.

On the face of it, it just seems to me like the majority of people in the Real Estate industry have not accepted reality. They desperately want the market circumstances of 2004 and 2005 to somehow return on a white horse with wings, and the believe the government is the friend that's going to take them there.

If I were a realtor or a homedebtor today, then I can certainly understand this rather self-centered and rather delusional thinking.

As a renter, I'm going to wait a few more months. There's just way too much sewage upriver (toxic loans that will foreclose) that the CAR and its members are apparently unwilling to table and discuss openly with prospective buyers like me.

Tuesday, December 22, 2009

Realtors' MLS Hides the Rancid Truth

Surprise!! MLS data are not accurate.

OK. So if real estate market conditions are local, and millions of Americans study local market housing conditions and even shop for homes on the internet at sites like Realtor.com and other MLS-linked database services, then why is the information therein so incomplete and inaccurate?

If "local" is the critical factor here for buyers and sellers alike, then why not make a concerted effort to clean up the slop?

ArrrghhhhH! When will we all stop asking such ridiculous questions!!!

Realtors declare "trusted advisor" status in their industry by fiat. Our first mistake would be to accept this preposterous claim and then understand it to have been supposedly earned sometime ago. They have NO claims to such authority. The colossal housing crash of California and the nation has thoroughly stripped realtors of any such authority.

This MLS problem really needs to be corrected. Not just because it's feeding consumers inaccurate and incomplete data. That can happen with any database. It should be corrected because of the massively incorrect inferences that can be, and are, regularly drawn from such "local" real estate market numbers.

See the excellent write up here by Dr. Housing Bubble Blog on the same subject.

Let's get it together people. First do the home work. Then you can maybe play princess in front of the mirror all you want. Declare yourselves empresses of the kingdom of ashes for all I care.

Sunday, December 20, 2009

Realtor.com: 4 Homes in Lake Forest Between $400-$500K

Why is it that there are only 4 single family homes (4 bed, 2 bath, 2250 sq feet) for sale listed on Realtor.com for Lake Forest in the price range of $400K and $500K?

Anyone want to submit a theory?

Man, you gotta love the locations shown here. If I only I were a nerd for trains.

California Realtors: 2010 to be "New Normal"

"I think what we're going to be doing in 2010 is building a foundation for what will be called the new normal. The recession is probably over as measured by a decline in growth, negative growth if you will. But the recovery will be contingent upon additionally likely stimulus spending and doing more to facilitate job growth because I really feel that if we don't do more direct policy initiatives aimed at putting people to work, this is going to go on for quite some time."

Not bad. For a realtor.

I'm pinching myself. Did she just say..? I'm pleased to observe a realtor in California finally displaying some measure of honesty about the situation we are all in and the uphill battle that most certainly lies before us in this state and around the nation.

California real estate appreciation, including appreciation of home values Orange County California, was based on a lie. Reckless lending practices, duplicitous sales tactics by realtors all across the state, not to mention financially inept and credulous decisions made by home buyers (homedebtors) all poisoned the water we're now swimming in together. Only now that water has become raw sewage do we understand. Ms. Appleton-Young knows and must now admit that the government is broke and it's probably going to take a very long time indeed for all of the crap to settle to the bottom, and for the stench of lies to be blown away by the ocean breeze.

The one thing I must disagree with Ms. Appleton-Young on is the call for more stimulus spending.

We DO NOT, I repeat, WE DO NOT need more American taxpayer dollars appropriated to prop up an industry that was built on lies and questionable sales practices in the first place. The price crashes all around California and Orange County are a market correction. This is not in dispute. It has been long overdue and repeatedly obstructed by the stimulus spending initiatives and political action committees funded by the CAR and NAR. Americans would benefit significantly more over the long term from a thorough housing market correction, not less of one. Stabilized markets should be our destination of choice, not the cliff hanging of the last 10 years. Of course, realtors would rather have the clocks turned back to the imbalanced market, irrationally high prices, lax lending standards, poorly informed and credulous buyers, and other craziness so that their own felt pockets could be appropriately lined with sales commissions.

I don't know about anyone else, but I don't pay my state and federal income taxes to support the REIC and the financial livelihood of California realtors. As far as I'm concerned that money should be used on something far more productive than rewarding debt slavery among those least capable of ever paying back such debts.

Get a Job, Orange County

Don't look now but, uh, unemployment in Orange County California went down from 9.7% to 9.4%.

I guess this is the part where we all start to celebrate about the employment tax dollars that are going to start flowing back into state and local coffers.

Tuesday, July 14, 2009

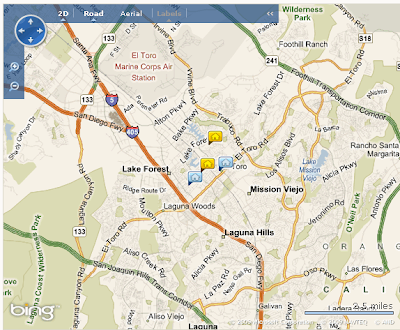

So You Want To Buy A SF Home In Lake Forest? Better Like Trains

I checked out Realtor.com today and searched for a home to buy given my annual income. I searched for a 4 bedroom 2 bath, any sq foot home in the $400,000 to $500,000 range.

Most of the homes for sale on Realtor.com in Lake Forest, California given such parameters are to be describes as - oh how shall I say this politely - pieces of shit. Most are run-down, poorly maintained short sales or foreclosures. And what's really amazing is how so few single family homes in Lake Forest have anything even closely resembling a backyard.

Anyway, I digress.

I found a whopping 21 listings on Realtor.com priced between $499,000 and $400,000.

One could decide to buy such a home at such a WTF price, but when I looked at the map I noticed something rather surprising. Most of the homes for sale were located very near to the Amtrak Train Line that runs right through Lake Forest on it's way northbound and southbound between Irvine and San Juan Capistrano.

Can you imagine paying between $400K and $500K to listen to this kind of nonsense day in and day out for 30 days, let alone 7 to 10 years?

Update Mid July 2009

Well, we're smack dab in the middle of summer. I've been busy as hell over the last several weeks both traveling and working on several major work-related projects.

Man, I hope everyone is hanging in there this summer. We are going to have a "very interesting" latter half of 2009. I feel it in my bones. Can you?

A lot's happened over the last month and half since my last post, but especially just recently:

$20 million in cuts for K-12 education in the Saddleback Valley Unified School District. If California ever gets to 47th rank nationally from 46th, do we send a gift basket to Governor Schwarzeneggar or to State Secretary of Education, Dr. Glen W. Thomas?

OC business and personal bankruptcy cases skyrocketed up to 62% in May 2009.

The California Association of Realtors shares with us that the median home price in Orange County is $474,110 (median family income in is $81,260), 6 times income.

Gee, one does wonder why Orange County is the riskiest housing market in the nation right now, or why foreclosures in California in July 2009 are up 24.7% year-on-year. Congratulations California and Orange County Realtors!

Dr. Housing Bubble shares with us another great, detailed post explaining how the FBI has found the state of California to be ranked No. 1 in the land in rampant mortgage fraud! Nice. First, a heaping helping of state-wide financial bankruptcy, followed by a tinge of moral bankruptcy for dessert. Dee-licious.

And in cas you want to know just why California is still issuing IOUs at Day 12 of the most embarrassing of state-wide budget crises, let me just clue you in. It is because:

a.) Each and every single California lawmaker in Sacramento is an incompetent, self-serving, cretinous dickhead. There are no exceptions.

b.) Californians voted these freaking idiots into office in the first place.

In other news that will probably shock readers of The Rancid Truth Blog to their very core, Realtors openly display their penchant for pathological lying.

I like Nick Gogerty's youtube video:

And finally, Lawrence Roberts at the Irvine Housing Blog, one of the finest educational resources you will ever find about the great housing crash (that is still ongoing to some degree at the nation-wide epicenter in Irvine), takes us back to a time of the last housing market bottom: 1997. Very informative read. Recommended.

Monday, May 25, 2009

Foreclosures Are Not Like Death

Sometimes you read a newspaper article and don't quite understand....what.....they're trying to....Did they just..?

There was an article in the Orange County register today written by Greg Hardesty and Rashi Kesarwani about local foreclosures and the psychological and emotional toll it is taking on local citizens and their families.

I think I understand the underlying message that is trying to be conveyed here (i.e. foreclosures are an event worthy of mourning), but I don't believe the three case examples cited are very supportive to the main idea.

Mr. Palmer's story is a sad one, but in my view it serves best as a textbook example of how deplorable health care costs have become in the United States these days, not to mention the soul-devouring frustration of dealing with disingenous healthcare insurers. Mr. Palmer's case serves to remind us all that even with the highest morality and greatest intentions to fulfill our contractual obligations, we are all just one serious illness or two away from permanent "foreclosure" ourselves.

The case of the Brixey family is so far removed from Mr. Palmer's, I almost got lost. OK, so I'm sure the Brixeys are going through a ton of mental anguish right now, afterall it must be quite difficult for large families with children to lose everything and start anew. However, it's pretty easy to see that, of the three stories described, the Brixey's probably utilized the least common sense and financial restraint in their decision-making over the last several years. I'm not saying they deserve foreclosure. I'm just asking the question after reading "$700,000" and "2005" in the same sentence, is this the part where we're all supposed to be shocked? I'm glad they're getting the help from friends and the community. But it is a sad and frustrating truth about Orange County real estate that very few constructed family residences here - even those priced at $700,000 - are really suitable for familes of three children, let alone six.

Cue the melancholy music and cut to a psychologist name Sharon Gerstenzang, Ph.D., of Fountain Valley who specializes in high conflict, trauma and crisis:

"Some mental health experts liken the experience to grieving over a loved one's death. Being foreclosed upon can sometimes be more than like a death in the family."

Well, I'm going to have to disagree with the honorable doctor on this one.

OK, so losing one's home may indeed be a traumatic experience that makes people very sad.

But foreclosure is not death, nor is it a "death in the family". If people are really feeling this way, then we have an incredibly mentally sick American society.

Homes are lost in fires and floods and storms in the hundreds every year across America. Also, family members are killed in traffic accidents, home accidents and violent crime. Some families are shredded by divorce. Some children go missing and are never found again.

Those are real examples of painful, brain-searing loss, from which few ever fully recover.

Relatively speaking, home foreclosure, while traumatic, is temporary. It ends. You can pick up your shit, move away and live on in another place. You can go rent a house or an apartmen and estabish a new life for yourself and family. You don't have the previous roof over your head, but you have yourself. And you have your family.

Most of the foreclosures in Orange County today, I suspect, are rarely related to Mr. Palmer's harsh circumstances. Life-saving drugs were so expensive and his insurance coverage was so restrictive that he decided he had no other choice but to leverage himself into oblivion to just stay alive! How in the fuck can the Brixeys or the Tiffins be placed on equal footing with that?

They shouldn't be.

Foreclosure is more often than not the end result of when individuals buy more house than they could really afford and cannot meet their financial obligations under contract (the mortgage). Not always, but frequently foreclosures are often linked to risky financial decisions made years ago that have resulted in default. Low to no down payments, pick-a-payment mortgage programs, adjustable rate mortgages and buying at the housing peak.

These are events brought about by a human being's own cognitive thought process and own volition. All of us would be wise not to compare such events with the loss of homes to natural disaster, or to the death of a loved one.

Sure, Americans who live their lives as if it were a Lifetime Original television series entitled "Foreclosure" with Meredith Baxter Birney, might wish their foreclosure to be as traumatic as death. I can imagine that it might "seem like death" for some to find out just how incredibly naive, foolish and financially inept they really were.

But foreclosure is not like death.

In fact, let me close by saying that every single foreclosure and bank owned property that doesn't get marked to market is preventing the very economic recovery that this entire nation will soon desperately need. How ironic is it that ongoing taxpayer support for over-leveraged homedebtors may result in the death of economic viability for the United States of America?

Saturday, May 2, 2009

Botox profit down 58% in 2009

You may notice that your local Realtor may not be looking their "best" lately. This may be one reason why:

Allergan Inc., maker of the wrinkle-smoother Botox, reported Friday that its first-quarter profit fell 58% as the recession slowed sales of eye and beauty products.

California Association of Realtors Use Outlaw Josey Wales to Sell Homes in 2009

The California Association of Realtors have chosen to dump their advertising dollars this summer into some fairly lame radio spots.

The first one is so dumb, I hesitate to post the link here. Man, it royally sucks. Not that one should expect much creativity from the NAR/CAR dudes.

SPECIAL NOTE TO REALTORS, THE CAR AND THE NAR ORGANIZATIONS:

Listen, we radio listeners have had quite enough of ads portraying dumbass married couples making stupid financial choices in your "appeal to action" ads, thank you very much all the same. We don't need to be reminded how emotionally self-centered, irresponsible and carefree people have been when working "side by side" with Realtors on the biggest purchase of their lives! Look, Century21 sort of ruined this theme for everyone with the Suzanne Researched This ad. I mean who doesn't remember the classic bloodsucking Realtor line: "This listing is special John! You guys can do this!!"

The second radio ad from the CAR has a very different theme. It's called "Piece of Me". A little bit of Dirty Harry mixed in with some outlaw Josey Wales and some Pale Rider.

The final message of tha ad is: "The California Association of Realtors. For your piece of California. For your piece of mind".

Christ. How appropriate is it that Realtors can suggest that any of their actions are responsible for home consumer "piece of mind"? I'm trying to figure out for the life of me what they could possibly mean by that. Where were California's Realtors when the notices of default started flowing in from the subprime crisis? Did they hold "Piece of Mind" seminars to former clients? Did they give back a piece of their ill-earned commissions on such garbage sales?

And just where are the California Realtors going to be when the tidal-freaking-wave of Alt-A and Option ARM loans first come up for recast this summer?

Honestly, how does using a 6%er help me or my piece of mind in buying a house in the third most fucked up real estate market in the country, southern California?

Oh, it's going to be a fantastic summer in California real estate, you can tell.

Man if I'm Realtor, I'd sure keep some extra funds available for the dry cleaners:

Wednesday, April 29, 2009

California Alt-A Foreclosures: A Wave of Mutilation

WAVE OF MUTILATION - The Pixies

cease to resist, giving my goodbye

drive my car into the ocean

you'll think i'm dead, but i sail away

on a wave of mutilation

a wave

wave

i've kissed mermaids, rode the el nino

walked the sand with the crustaceans

could find my way to mariana

on a wave of mutilation,

wave of mutilation

wave of mutilation

wave

wave of mutilation

wave

Housing Ladder To Nowhere

I've posted a number of local, Lake Forest, Calfornia examples where, during the time frame of approximately 2004 to 2007, people really bought in to the irrational exhuberance over "owning a home" and paying top dollar. The housing ladder only went up and the number of rungs was believed to be unlimited.

The examples I've cited have been mainly single family homes, and typically with 4 bedrooms, 2 baths or more. I want to make this important distinction, because none of us should lose sight of the fact that families are involved here. The lives of parents and children are probably being turned royally upside down by these trying financial times.

In my view, people who work today in the real estate profession rarely if ever admit to the social impact of their recent handiwork. Realtors, mortgage lenders and bank CEOs will talk all day about new listings, median home prices, monthly sales numbers and perhaps notices of default, the new tools for their website, and a recent closing experience, etc. But they don't seem to fully appreciate that behind all of these astonishing numbers are people. People just like you and me. People with hopes and dreams. People with worries and loves.

The downturn in the California housing market has quantifiable ramifications to be sure: bankruptcies, business closings, lost state and federal revenues, lost tax dollars, federal and state budget crises, increased taxes, unemployment (housing related and other), budget-related degradation of public services, and reduction in funding to school districts. These are serious, quantifiable issues that we've only begun to come to terms with.

But the other side of the coin is equally blemished. The social price tag of this downturn may not be known for many years. The housing market bubble and crash has affected people personally and psychologically in terms of their daily stress, their overall health, as well as the cohesiveness and well being of families. It may be too that the crises brings people closer together than before, which would be a good thing. My posts on this blog have often been sarcastic and angry. However, I do feel badly for those who made honest mistakes and for those who suffer because of them, especially young kids who may not fully understand what's gone wrong.

Since I started The Rancid Truth Blog about Orange County Real Estate in 2005, I was pissed off. Really pissed off. I've worked very hard, traveled extensively and earned good money. I've paid more than my fair share of state and federal income taxes, yet I have been utterly priced out of the volatile housing market here. I should be paying more for the privalege of renting a single family home, but I'm not. It's cheaper to rent here. And we all know today that Orange County California home prices were fueled by snake oil sales people (liars), irresponsible lending, irresponsible borrowing (lying on mortgage qualification docs), and unabashed greed.

And I'm still pissed off about all of this.

Sure, I was the responsible one. I didn't take massive risks, yet my federal and state taxes are going up, my rent stays the same, yet I'm helping unqualified people stay in homes that they can't afford, and that I might otherwise have been in a position to buy myself (if prices where allowed to adjust) and assume all of the responsibility that this might entail, including paying local property taxes.

I'm convinced that I'm right to be angry about what's happened here (and still happening here), and to demand change. I don't want a medal for being financially prudent the last 4 years. But I do think that the housing market needs to be allowed to shake itself out and correct, fully understanding and appreciating that there will be significant financial and social casualties in the process. The sooner the market heals itself, the sooner it can recover.

On to today's example:

The setting is June of 2005, Lake Forest, California. The single family housing market is white-hot. Home buyers, lenders and Realtors are living the high life. Homes are selling like umbrellas during a rainstorm, and at stratospheric prices.

A lovely 4 bedroom, 3 bath single family home, 2,150 sq. feet and 10,800 sq foot lot (most of it on a useless backyard incline) located in the beautiful Bennett Ranch area, sold to a new owner for $680,500. That's $311/sq foot.

Fast forward 6 months later to January 2006. The home sold again, this time for $795,000! That's $370/sq ft!

It's now April 2009 and the home has shed it's toxic loan glamour and become a short sale offered at $445,000 ($207/sq ft).

25551 Glen Acres, Lake Forest, CA 92630

Glen Acres is the place to be.