California home sales increased 4.7% in November 2009 vs. 2008, and median home prices increased 5.8% in November as well.

This sounds fantastic. The residential housing market in California is getting revved up for a jaw-dropping recovery.

Right?

C.A.R. President Steve Goddard:

“Efforts by lenders and the government to assist homeowners at risk of foreclosure have led to fewer homes available for sale, and an increase in the state’s median home price. California’s median home price increased year over year in November for the first time since August 2007."

So government and lender actions have restricted market supply ("homes available for sale") in California resulting in "an increase in the state's median home price". So the market has actually not truly corrected itself yet. Without foreclosure moratoriums and government and lender finger fumbling, we might see a different set of circumstances. Higher volume supply of homes for sale and higher pressure to lower prices perhaps?

Mr. Goddard again:

“The extension and expansion of the tax credit until April 30, 2010, along with low interest rates, should continue to positively impact the market in coming months."

Is it just me or does it seems like Mr. Goddard and the California realtors he represents generally view a "positive impact" on the housing market in California to include following:

- low interest rates

- low market supply of homes for sale

- high sales prices

- federal tax incentives to encourage people to buy a home now

So I ask you:

Are low interest rates really a good thing?For the short term home affordability? Maybe. But what happens, my realtor friends, when rates increase and the people who have been encouraged to buy now at $500K and $600K with these low rates decide to or must sell their homes in 2, 3 or 5 years and rates are significantly higher? I don't think they'll share your present views on this subject. The time to buy a home is not when rates are at their lowest, but when rates are at appropriate or even high levels. When rates go up, sale prices (and asking prices) typically must and do decline. When rates are low, sale prices are normally quite high (as they remain to be in Orange County California, for example). If I buy a $550K SF home today at 4.75%, in 5 years when rates are 8% or 9%, if I have to sell, I'm going to be f%$#ed.

Is a low market supply of homes for sale a good thing?If you like to see high sales prices per home, then of course. This is great news for home sellers. As for potential buyers, well, this is the part where you're told to get in and pay now, miss the train, or piss off.

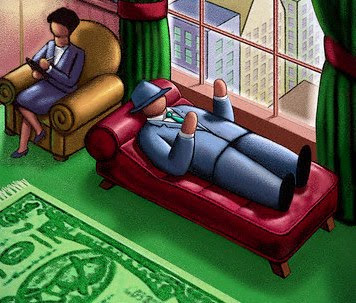

Are high home sales prices a good thing?For sellers, definitely. Who doesn't want to sell a $230K piece of shit single family home in Lake Forest, California for $550K or $600K? Most homedebtors who live here already have this expectation. You'd have to be out of your mind not to love such a scenario. But why in the world would realtors be in favor of high home sales prices?

Gee, I wonder.

Are federal tax incentives to encourage people to buy now a good thing?Government intervention certainly has it's place in both micro- and macroeconomic market scenarios. It can be a highly effective catalyst for stabilization and regulation, leading to economic recovery of either ailing and devasted (past tense) markets. The residential housing market has almost been reduced to ash in California. In some parts of the state (you know, since Real Estate is LOCAL!!), there is more incineration in store (in places such as Orange County once the tens of thousands of Alt-A and Option ARM mortgages come tap, tap, tapping at our tax-paying, chamber doors). Realtors want the government to provide the market these incentives to keep the market on life support, because if the government doesn't to this, then realtors either get lower sales commissions (from lower market sale prices per unit sold) or won't get paid at all (from far fewer home sales and transactions). I not only think this is a morally wrong position for realtors to take (as government incentives cost everyone a lot of tax dollars). It's economically unsupportable as well.

The housing market in California has been made sick by a combination of irrational exhuberance, irresponsible lending, irresponsible sales tactics, and irresponsible borrowing. What the residential real estate market in California really needs to do is take a freaking bath. First in its own blood, then in lye.

Government incentives should be withdrawn completely. $8,000 is a ridiculously small amount of money for California anyway. No more moratoriums and price baiting would spur a different market response. The supply of homes in the market would likely increase, the sales prices would decline for a time, but you would have higher affordability, good competitive bidding and more stable single family home prices over a longer term. Plus, the market would correct itself a lot faster. This would be a good thing for sellers, buyers and realtors alike - but over the longer term.

On the face of it, it just seems to me like the majority of people in the Real Estate industry have not accepted reality. They desperately want the market circumstances of 2004 and 2005 to somehow return on a white horse with wings, and the believe the government is the friend that's going to take them there.

If I were a realtor or a homedebtor today, then I can certainly understand this rather self-centered and rather delusional thinking.

As a renter, I'm going to wait a few more months. There's just way too much sewage upriver (toxic loans that will foreclose) that the CAR and its members are apparently unwilling to table and discuss openly with prospective buyers like me.