Realty Times yesterday posted a tear-jerking story about how difficult the battle has been for the N.A.R. (National Association of Realtors) against an apparent smear campaign by the American mainstream media. The MSM, Realtors say, has been suggesting that the N.A.R. is a self-serving organization.

Not so, says Realty Times.

Here's the truth according to Realtors:

1.) If it weren't for the N.A.R. and realtors everywhere, wreckless politicians in Washington would simply remove the mortgage interest tax deduction, which would force American homeowners to pay income taxes on interest payments made on their mortgages.

2.) For the past 30 years, the median price of existing homes has increased an average of more than 6 percent every year, and home values nearly double every 10 years.

3.) Home prices typically beat inflation by one or two percentage points.

4.) Housing sales in 2007 are expected to be the fifth-best on record.

Realty Times elaborates further comparing the merits of owning a home to the big SUV you may (or may not) have parked in your drive way. (Do all realtors assume that homeowners are wealthy and therefore "own" an SUV?. I'd be willing to bet that the majority of those homeowners are actually "homedebtors" and therefore "SUV-debtors" too. And many are probably pissed off that they are in debt for either):

"So if your Chevy Tahoe doesn't have your panties in a twist, housing

shouldn't either. Especially when it's expected to go up 3.1 percent in

2009, which I guarantee, your SUV won't do."

Yes, that's a pretty safe guarantee. But sort of an irrelevant analogy.

What most realtors like to leave out in these tirades is that home values can and do go down too, and sometimes (like now) rather dramatically and that it can fuck up your life in big ways.

Realtors don't view themselves as having been guilty of pumping up real estate the last 10 years "getting in now" and "buy now while rates are low" and "it's high priced now, but you can always re-finance". This is where the Realtor and N.A.R. credibility started to go down the tubes.

It's like the CEO who gets paid $16,000,000 in compensation and takes all the credit for when the company's revenues grow and it's stock price sky-rockets. It's all attributable to his leadership.

"My compensation is well-deserved. Just look at the stock price!", says the CEO.

Then when that same company tanks in the market (Gee, Citicorp, Merrill Lynch, CountryWide come to mind now, don't they?) but the CEO still believes he is entitled to the $16,000,000 compensation package plus benefits.

Didn't he just say that the growth of the company was "attributable to his leadership"?

Well, logically then would not the downfall of the company's stock price and value also be attributable to his leadership??

The answer is yes.

Unfortunately, few if any such CEOs payout any equalization back to the company as to their compensation at the end of their tenure. Most are even paid more money - a golden parachute -despite a collossal failure to run the business appropriately.

And so it is with realtors and the N.A.R.

You can't claim to be the Trusted Advisor, the only line of defense against tax-dollar-hungry politicians in Washington, then pump up home prices, and pump up that idea that real estate never goes down, without losing credibility when the market sours.

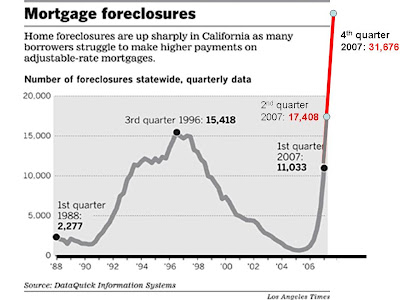

The Housing Crash of 2007-2008 will be long and painful. It will not end quickly. The realtor playground will not, in my opinion, rebound in 2009 either. I guarantee you that the N.A.R. has no empirical evidence to suggest such a 2009 rebound is even remotely possible given the state of play in the market surrounding cost per square feet, inventory, crashing prices, foreclosures, bankrupt credit institutions, limited access to financing, and most important - median incomes in America.

It doesn't matter, Realty Times, what the median value or historical median price of the home is or was. That's just bullshit pie-in-the-sky talk. What matters are three things: 1.) today, not yesterday, 2.) what the price of the home is when it is being sold (affordability) and 3.) whether or not the buyer has the financial means and funding to buy it (access to financing).

Indeed, purchasing a home can be a good long-term investment as long as the price of the home is in alignment with a homedebtor's real income (not a lie) and the mortgage instrument used to fund it is conventional and not subject to dramatic changes that affect affordability.

The N.A.R.s argument here against the mainstream media wouldn't be such an uphill battle if realtors would have the balls to tell prospective clients the following:

"I'm going to level with you, Mr. Prospective Buyer. Now is not a good time to buy a home. Prices are too high and are set to fall. If you can wait 6 to 12 months, rent a home in the meantime, then do it. Access to financing is starting to tighten up. Your will need to evaluate your real take home income and align that with the sale price of the homes you wish to buy. Buying a home is a good investment long-term, but short-term or long-term, the value of homes can and do go up and down dramatically over time. This is the biggest, most important purchase you will make in your lifetime. It would behoove you not to fuck it up."