Look at that smile. More damning evidence that Bush never made it to the 8:00 a.m. ECON 110 class in college.

Look at that smile. More damning evidence that Bush never made it to the 8:00 a.m. ECON 110 class in college.George W. Bush and the 110th U.S. Congress agreed today to further mortgage away the future of America's young people via the passing of an historic economic stimulus plan designed to ward off normal market correction in housing and the economy at-large, and to maintain some semblence of the preposterous Greenspan-concocted status quo.

Inman News captures some of the wonderful details.

California can be proud that it's own congresswoman Nancy Pelosi sponsored the bill HR5140 alongside 15 other corruptoids whom readers of the Rancid Truth Blog may wish to write:

Rep Bachus, Spencer [AL-6] - 1/28/2008

Rep Becerra, Xavier [CA-31] - 1/28/2008

Rep Blunt, Roy [MO-7] - 1/28/2008

Rep Boehner, John A. [OH-8] - 1/28/2008

Rep Clyburn, James E. [SC-6] - 1/28/2008

Rep DeLauro, Rosa L. [CT-3] - 1/28/2008

Rep Emanuel, Rahm [IL-5] - 1/28/2008

Rep Frank, Barney [MA-4] - 1/28/2008

Rep Granger, Kay [TX-12] - 1/28/2008

Rep Hoyer, Steny H. [MD-5] - 1/28/2008

Rep Larson, John B. [CT-1] - 1/28/2008

Rep McCrery, Jim [LA-4] - 1/28/2008

Rep Miller, George [CA-7] - 1/28/2008

Rep Obey, David R. [WI-7] - 1/28/2008

Rep Rangel, Charles B. [NY-15] - 1/28/2008

So now mortgage loan limits, which were already at an all-time Fantasia Land high of $372,790 in high-cost markets (like Orange County and all of California) prior to HR5140, will now be inflated temporarily until December 31, 2008to $729,750!

(Very nice. I'm still thinking that auto loans might be next! Just imagine what you would buy with $200,000 auto loan limit? )

In addition, some Americans will be receiving checks from the U.S. government (Mother Gov) of anywhere between $200 and $600 in an effort to cajole everybody to just "go crazy".

Hey! Thanks mom!

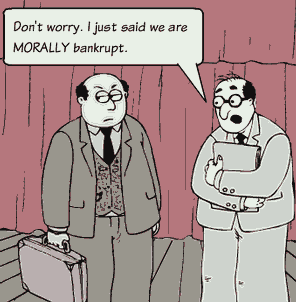

Last I checked, the

U.S. government was effectively bankrupt (if it weren't for the ability to print money).

So have scientist recently frankencloned some sort of money-making tree?

Just where the fuck is all of this free money supposed to come from?

Well, it's really quite easy. The answer is:Just borrow now and never pay it off. Force the younger generation to deal with that debt sewage. Just ensure that the current generations can live the status quo. There will be no tough decisions made now. No freaking way.

How much will H.R. 5140 cost future American taxpayers? Get a load of

this from the Congressional Budget Office (CBO, or soon to be called

CBzero):

H.R. 5140 would provide a tax rebate to individual tax filers who satisfy specific income requirements and special depreciation allowances for businesses.

In addition, the act would raise the loan limit for the Federal Housing

Administration single-family program. The Congressional Budget Office and Joint

Committee on Taxation estimate that H.R. 5140 would:

- Decrease revenues by $114 billion in 2008 and by a net amount of $82 billion between 2008 and 2018 (Total $196 billion?)

- Increase direct spending by $38 billion in 2008 and $42 billion over the 2008-2009 period.

In total, those changes would increase budget deficits (or reduce future surpluses) by $152 billion in 2008 and by a net amount of $124 billion over the 2008-2018 period.

All of the provisions of H.R. 5140 are designated as emergency requirements pursuant to Section 204 of S. Con. Res. 21 the Concurrent Resolution on the Budget for

Fiscal year 2008.

A few additional comments from this editor:

1.) Fuck!

2.) Anyone who voted for George W. Bush in 2000 and/or 2004 must now finally concede that they were very stupid to have done so. George II is not a fiscal conservative, nor a true Republican. He has presided over the beginning of the end.

3.) Sorry kids.

4.) The CBO's report section entitled "Estimated Costs to the Federal Government" indicates that H.R.5140 also sets aside

$300 million for administrative expenses. (Click and open the PDF files). 5.) It's a political year and since Americans are held hostage by 2 horrible and non-representative political parties, here's my take on the political dogma regarding "taxes":

Democrats are accused of raising taxes and spending money like maniacs. Every time. No exceptions. Tax and spend is just part of the Democrat's fabric.

Republicans, conversely, do not raise taxes. They claim to only lower them. They lower them and then lower them some more. Republicans claim to lower taxes for the middle class. (I don't believe that the evidence bears this out since both Reagan and George I, for example, both signed income tax increases during their tenure). When Republicans get done backslapping and congratulating each other on not raising taxes to anybody, they start to borrow. And they borrow. And they borrow, borrow, borrow, borrow. Never stop borrowing.

Democrats and Republicans utilize different methods to finance projects, but do we witness different results?

While American taxpayers and workers are not looking, Democrats drive a sucker punch to the belly in the form of tax increases for social programs and entitlements.

Republicans spare the American people the sore belly today, preferring instead to politely deliver that same sucker punch to your little children and your grandchildren.

With Democrats in power, the financial suffering commences immediately. With Republicans in power, America is on the deferred suffering plan. This is the way each species survivese polictically.

If Markus Arelius were king, the H.R. 5140 should be torn up in place of the following initiatives:

Balance the U.S. national budget. Now.

Reign in federal spending across the board.

Income tax code should be simplified with a flat tax.

Businesses large and small should be incentivized (lower corporate taxes and credits) heavily to create jobs and products/solutions within U.S. shores

Campaign finance reforms must be implemented.

Televangelists, churches, Hollywood and Oprah should all stay the hell away from government affairs and federal coffers.

The rule of play is let the markets decide. Americans have forgotten that Laissez-faire capitalism can be a powerful ally

Secure the borders by force using the Army, Navy, Airforce and Marine forces as if we were surrounding the Tora Bora region.

Fire the TSA thoroughly and completely. Hire fully-trained U.S. military security personnel to perform airport security.

Build a 15 meter high fence from Texas to California at the Mexico border. Use the U.S. military to patrol and monitor the border.